The day before Thanksgiving, the stock market took a little breather. But the weekly performance was still impressive.

The day before Thanksgiving, the stock market took a little breather. But the weekly performance was still impressive.

The Dow Jones Industrial Average ($INDU) remains the broader index leader, rising 0.96% for the week. The S&P 500 ($SPX) and the Nasdaq Composite ($COMPQ) ended the week with smaller gains than the Dow. Earlier in the week, investors were more bullish, but Wednesday’s selloff didn’t disrupt the uptrend.

It may have been a short trading week, but we got a handful of economic data to chew on. The revised Q3 GDP data shows the US economy grew at a 2.8% annual rate, last week’s jobless claims came in lower than expected, and durable goods fell 0.2% in October.

The Fed’s preferred inflation gauge, PCE rose 2.3% year-over-year in October, which was in line with expectations but slightly higher than last month’s 2.1% rise. This indicates that inflation is moving away from the Fed’s inflation target of 2%. Core PCE came in higher at 2.8% year-over-year.

Earlier this week, we had the FOMC minutes. They indicated that the Fed will gradually cut interest rates if the economy continues to perform as expected. According to the CME FedWatch Tool, there’s now a 66.5% probability of a 25-basis-point rate cut in the December meeting.

The Stock Market’s Reaction

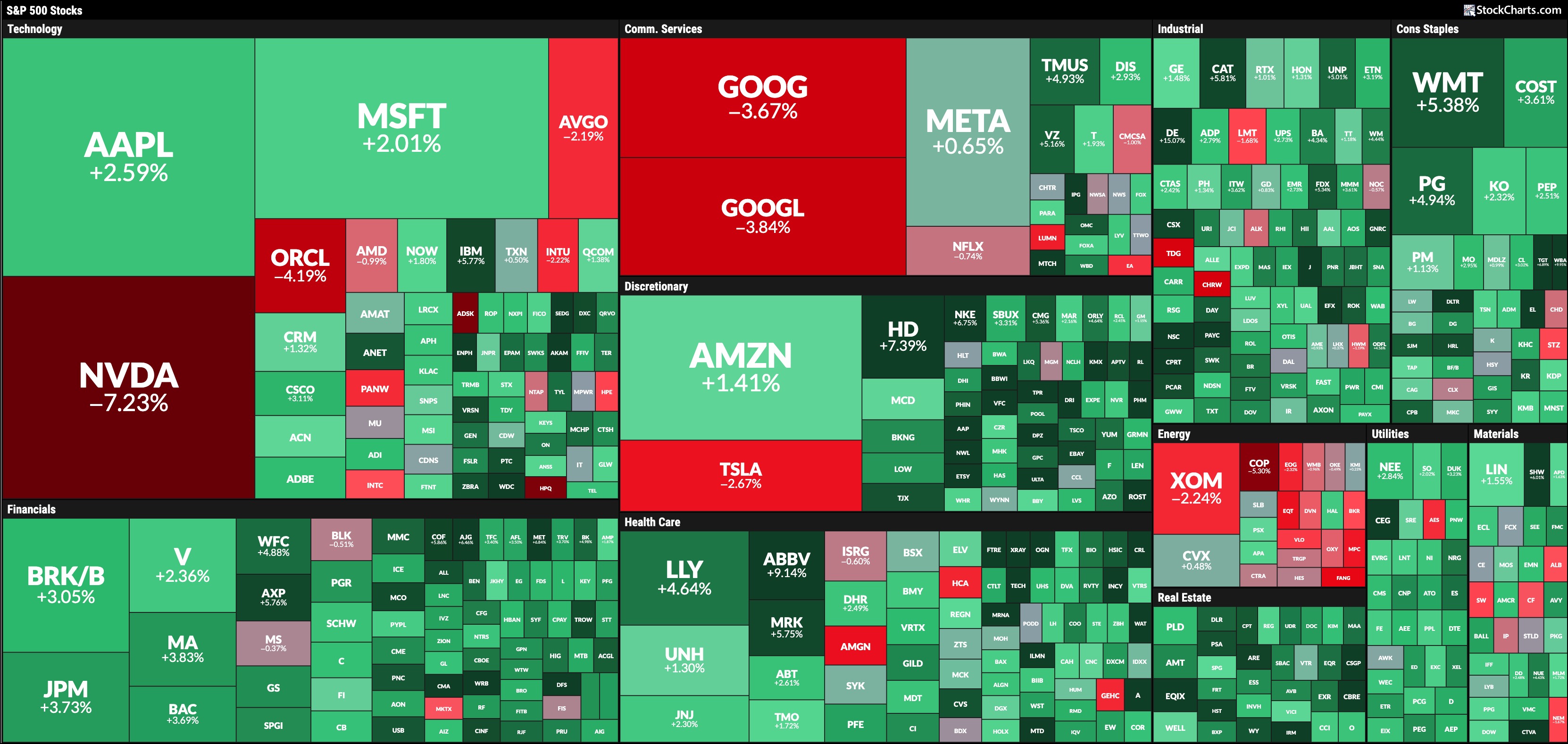

Looking at the 5-day change in performance using the StockCharts MarketCarpets, heavyweights NVIDIA Corp. (NVDA), Alphabet Inc. (GOOGL/GOOG), and Tesla Inc. (TSLA) were the largest decliners. The performance of these large-cap stocks would have been the tailwinds that held the Nasdaq and S&P 500 back.

FIGURE 1. 5-DAY PERFORMANCE OF THE S&P 500 THROUGH THE MARKETCARPET LENS. There’s a lot of green, but some large-cap stocks saw declines.Image source: StockCharts.com. For educational purposes.

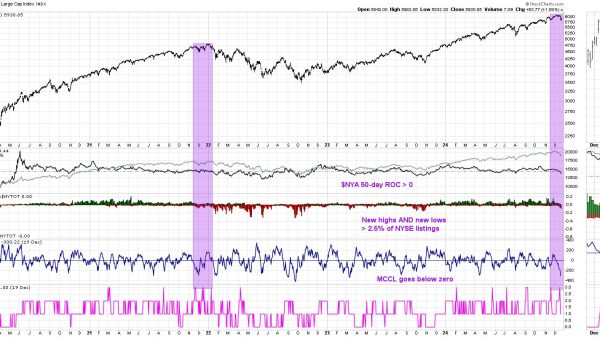

This week, money rotated from energy and technology stocks into real estate, consumer staples, and financial stocks. Antitrust efforts against Alphabet and now Microsoft, along with tariff talks impacting semiconductor stocks, have hurt the stock prices of several mega-cap tech stocks. With cash leaving these stocks, small- and mid-cap stocks have benefited, although they, too, came off their highs by the end of Wednesday’s trading.

The Dow reached an all-time high on Wednesday but sold off, ending the day slightly lower. The uptrend is still intact, as seen in the daily chart below.

FIGURE 2. DAILY CHART OF THE DOW JONES INDUSTRIAL AVERGE ($INDU). The uptrend is still intact with the 21-day EMA, 50-and 100-day SMAs trending upward. The Dow is outperforming the S&P 500 slightly.Chart source: StockCharts.com. For educational purposes.

The Dow is trading well above its upward-sloping 21-day exponential moving average (EMA). It’s also slightly outperforming the S&P 500 by 1.27%. The S&P 500 has a similar pattern, but the Nasdaq Composite is struggling.

The daily chart of the Nasdaq below shows that it is underperforming the S&P 500, albeit slightly.

FIGURE 3. DAILY CHART OF NASDAQ COMPOSITE. Even though the Nasdaq is the weaker performer of the three broad indexes, its trend is still positively sloped and holding the 21-day EMA support. The Nasdaq is underperforming the S&P 500 slightly.Chart source: StockCharts.com. For educational purposes.

The long-term trend is still in play. The 21-day EMA is trending upward and continues to be a valid support level for the index.

In the Bond World

The biggest action this week was the sentiment shift in the bond market. Treasury yields were rising until last week. However, several events this week have eased inflation fears, resulting in declining Treasury yields and rising bond prices (bond prices and yields move in opposite directions). Wednesday’s PCE data didn’t change the directional move.

The chart below shows that the 10-Year US Treasury Yield ($TNX) met resistance at its July 1 close and reversed. It is now trading below its 21-day EMA.

FIGURE 4. DAILY CHART OF THE 10-YEAR US TREASURY YIELD. The 10-year yield hit a resistance level and, since then, has been trending lower. It is now trading below its 21-day EMA. The rate of change (ROC) indicates the decline is accelerating.Chart source: StockCharts.com. For educational purposes.

The rate of change (ROC) indicator in the lower panel is below zero. This means that yields are falling relatively quickly.

The bottom line: Equities may have sold off on Wednesday, but nothing to disrupt the uptrend. A little profit-taking ahead of the holiday shopping season shouldn’t come as a surprise. You deserve to celebrate consumerism once in a while.

Wishing everyone a happy, healthy Thanksgiving!

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.