With days remaining until Tuesday’s presidential election, the candidates are making their closing arguments to voters. One area Kamala Harris and Donald Trump have in common is their willingness to wield federal power to favor or disfavor particular businesses.

During his 2016 presidential run, Trump promised to “tax the hell” out of Carrier products for relocating an Indiana plant to Mexico. As president-elect, Trump and vice-president-elect Mike Pence (Indiana’s governor) cajoled Carrier’s parent company, United Technologies, to keep the Indiana plant. The change of heart stemmed from a $7 million gift from Indiana taxpayers and a direct “reminder” from Trump to United Technologies’ CEO that the company benefits from billions of dollars in federal defense contracts.

As president, it was more of the same behavior:

• Trump threatened Harley-Davidson with “taxes like never before” after the company announced plans to move more production overseas due to tariffs imposed by the European Union in retaliation for his tariffs on steel and aluminum imports.

• After previously criticizing General Motors for building cars in Mexico, Trump threatened the company for announcing plans to stop production at uneconomical facilities in Michigan and Ohio. Following a call to GM’s CEO, he told The Wall Street Journal, “They better damn well open a new plant [in Ohio] quickly.”

• In response to unflattering coverage of the president by The Washington Post, Trump attacked Amazon because CEO Jeff Bezos owns the newspaper. Calling the US Postal Service rates paid by the company a “scam,” he posted on Twitter that “Amazon must pay real costs (and taxes) now!” The following year, the Department of Defense (DOD) surprisingly awarded a $10 billion cloud-computing contract to Microsoft instead of Amazon, which was the presumptive favorite. The DOD’s decision came after Trump asked the Pentagon to look “very closely” at the contract.

• Trump used the official @POTUS account on Twitter to attack Nordstrom because the department store announced it would no longer carry his daughter Ivanka’s label “due to performance.”

• Following what he deemed an insufficient response to deadly violence at a white nationalist protest in Charlottesville, VA, the chairman and CEO of Merck resigned from the president’s manufacturing council. Trump responded on Twitter that “Ken Frazier of Merck Pharma … will have more time to LOWER RIPOFF DRUG PRICES!”

• In response to social media companies silencing certain views, Trump stated on Twitter that, “We will strongly regulate, or close them down[.]”

• Trump’s Department of Justice fought AT&T’s purchase of Time Warner on anti-trust grounds, but a judge ultimately approved the merger. AT&T owned CNN’s parent company, Turner Broadcasting. Claiming that CNN wasn’t fair to him, Trump had told a crowd a month before the election that “AT&T is buying Time Warner, and thus CNN … a deal we will not approve in my administration.”

The bullying continues on the 2024 campaign trail. As I recently discussed, Trump threatened to place a 200 percent tariff on John Deere tractor imports at a Pennsylvania rally because the company had announced plans to move some production to Mexico. He has threatened automakers with similarly massive tariffs should they move any manufacturing operations outside the US, although that’s been a regular threat since his first presidential campaign.

The flip side to a president disfavoring particular companies is favoring particular companies. For example, Scott Lincicome notes the Government Accountability Office found that the Trump administration’s “process for excluding certain goods from the tariffs suffered from political favoritism, untimeliness, and a lack of transparency.” Another study found that companies supporting Republicans, including Trump, were more likely to receive tariff exemptions. Trump also oversaw billions of dollars in taxpayer bailouts for farmers hurt by retaliatory tariffs.

A common excuse for Trump’s behavior is that he is a businessman and thus just employing his negotiating and deal-making prowess. In 2020, the Chinese company that owns TikTok came under bipartisan pressure to sell it to a US company. Trump stated that a large share of any sale proceeds would have to go to the Treasury, which he called “key money.”

Personal finance expert Rob Berger explains:

Key money is a dated term used in real estate transactions. It’s money a prospective tenant would pay under the table to a landlord, building manager or even another tenant to secure a lease. Think of a middle school bully demanding another student’s lunch money in exchange for safe passage.

Call it extortion or call it “Art of the Deal,” the fact remains the federal government is not a business. John Adams famously defined a republic as “a government of laws, and not of men.” As I explained years ago, government favors (or disfavors) for specific companies are “not just bad economic policy; they also violate the bedrock American principle of equality under the law.” That our country has failed, and continues to fail, to uphold that principle does not mean that it should be casually waived away when it serves a political preference.

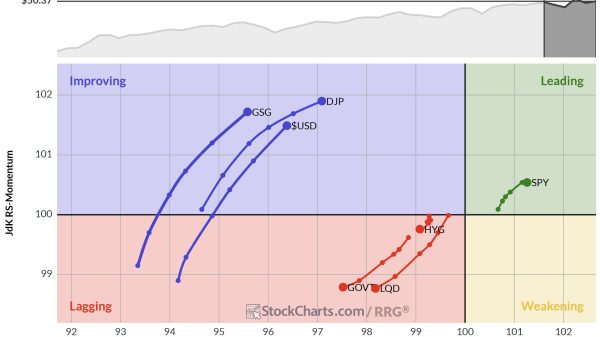

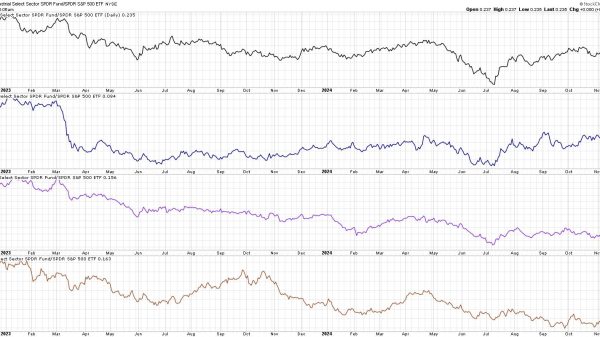

Now, in our current hyper-polarized political environment, the criticism of either Trump or Harris often invites “whataboutism.” To be clear, I have no horse in the presidential race. The idea for this post sprung from Scott’s recent discussion of the undesirable connection between policy uncertainty and economic uncertainty (the former fuels the latter). He notes, for example, “The Biden administration’s own [Electric Vehicle] subsidies and regulations … have been modified repeatedly, with dramatic and unforeseen effects on the U.S. market.”

When candidate Harris says her administration will make “investments” in the US economy, she often means she wants to use taxpayer money to subsidize commercial interests she favors. She’s also attacking businesses for having the audacity to, well, conduct business.

From Ryan Bourne in today’s Financial Times:

Yet Democrats stubbornly deflect attention away from macroeconomic policy, even pretending that the federal government can compel companies to lower prices. Indeed, Harris is promising various price controls to reduce living costs. She proposes a federal law to limit how much supermarkets can increase food prices during emergencies. She also advocates for national rent control to cap increases from “corporate landlords” at 5 percent annually, along with government regulations to tackle “junk fees” across various sectors.

While Harris’s rhetoric may not meet the floor Trump has set, she is nonetheless bullying when she proposes to use federal power to “make clear that big corporations can’t unfairly exploit consumers during times of crisis to run up excessive corporate profits on food and groceries.”

Speaking to a crowd in North Carolina, Harris nonchalantly attributes high food prices to pandemic-induced supply shocks and implies “big food companies” have taken advantage of the situation to make “their highest profits in two decades.” It was government policy, very much including the Biden-Harris administration’s spending spree, that sparked inflation. But “big corporations” make for easy scapegoats.

So, who is worse? Readers can quibble over that question. Unfortunately, whichever candidate wins, American businesses in the economic arena will have to continue looking up at Caesar to see if they get the thumbs up or thumbs down.